REIT investing has historically proven to be a powerful, high-yield strategy for ambitious inventors.

This guide has been assembled by the team at Silver Star Properties REIT which grew out of our early investment efforts in the Dallas, Houston, and San Antonio, Texas markets. The company and group have evolved, establishing a significant presence in the area. This guide will help you better understand the dynamics around REIT investing.

A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate and selects special tax treatment that exempts it from federal income taxes on its corporate income and gains that it distributes to its investors.

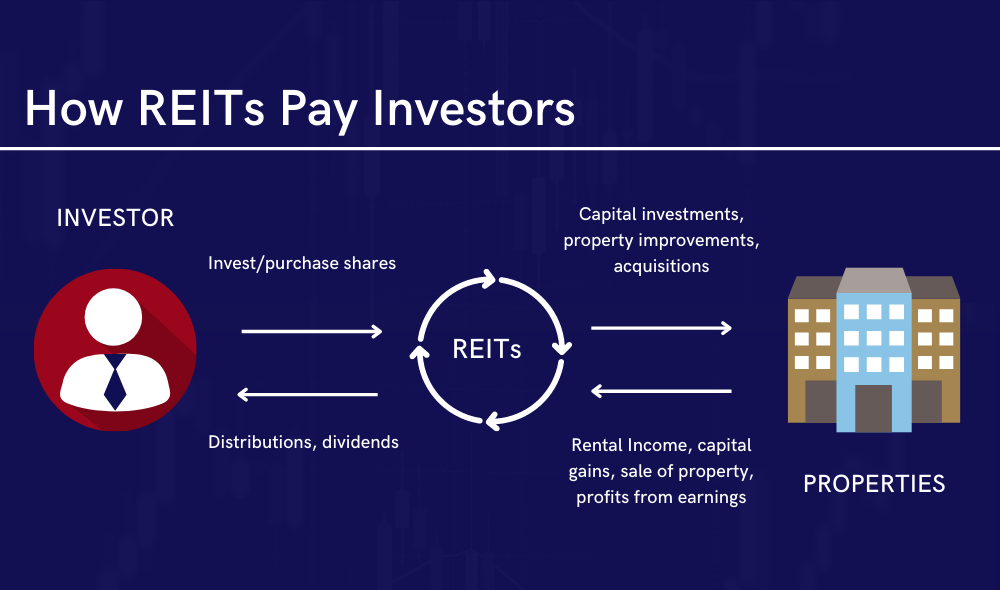

Modeled after mutual funds, REITs function by pooling capital from numerous investors, making it possible for individual investors to earn dividends from real estate investments, all without having to buy, manage, or finance any properties themselves.

1. Historically, REITS have produced competitive total returns due to steady dividend income and long-term appreciation.

2. REITs can lower overall portfolio risk, as they diversify portfolios and offer a low correlation with other assets.

3. REITs make it possible for anyone to invest in real estate, not just high net worth individuals.

REITs can play an integral role in a balanced investment portfolio because they can offer a strong, stable annual dividend and the potential for long-term capital appreciation. Like any investment however, REITs have both advantages and disadvantages.

PROS:

CONS:

You can invest in REITs by buying stocks or shares in either a publicly traded or privately purchased REIT. Whether a REIT is publicly or privately traded is an extremely important distinction when investing in order to understand the associated risks and benefits.

Publicly traded REITs are registered with the SEC and publicly traded on a stock exchange.

Non-traded Public REITs are registered with the SEC, but are not traded on a stock exchange. They are typically sold by a broker or financial adviser. Non-traded REITs generally have high up-front fees. Typically, sales commissions and start up fees can total up to ten percent of the investment.

While REITs can be traded publicly, not all REITs are. This makes them more difficult to invest in, and can require investors to make a more substantial investment.

Private REITs are funds and companies are exempt from SEC registration. Meaning private REITs include shares that do not trade on the national stock exchange. Typically, private REITs must be bought through your financial advisor at a brokerage. Investors should check with a financial advisor to see if they qualify as an accredited investor.

Different REITs will own different real estate assets, each of which come with various benefits and considerations. Depending on the type of REIT assets, investors may experience varying risks and ROI’s. For instance, REITs can include office space, retail space, or flex space, as examples, or combinations of different assets. Let’s review the defining features of the different types of REIT investments.

Equity REITs are trusts that generate income from renting real estate to tenants. Income is distributed to investors through dividends after paying property management fees and other expenses of operation.

Publicly registered/publicly traded – Publicly registered and publicly traded REITs means the REIT is both registered with the SEC, and publicly traded on the national stock exchange. Theses REITs are marked by high liquidity because they can be sold or traded at any time.

Private REITs are real estate funds or companies that do not trade shares on the national stock exchange, and therefore are exempt from SEC registration. For this reason, they can only be sold to institutional investors.

For individuals looking for portfolio diversity, hybrid REITs are comprised of both equity and mortgage holdings. For both a more growth-oriented or income-oriented portfolio, hybrid REITs can provide better protection from market fluctuations.

Investing in a REIT means investing in an entire portfolio of income-producing real estate or mortgages, or a hybrid of both. To perform proper due diligence, it’s important to consider a number of key factors to assess the viability of a REIT investment.

1. Review the REITs portfolio of properties.

This should include review of existing tenants, lease terms, rent collection timelines, acquisitions, and dispositions. Pay special consideration to the business health of existing tenants, length of leases, history of rent collection, and whether the REIT’s portfolio is growing or declining.

2. Review the valuation of the shares/stocks.

Pay close attention to FFO (funds from operation), Price to FFO, AFFO (adjusted funds from operation, and NAV (net asset value) in order to paint a complete picture of true earnings.

In addition to the above research, consider two additional points of precaution. First, evaluate the liquidity of the investment depending on the type of REIT sector. Second, investors should consider the ability to reinvest dividends. Understand whether it is possible to start with a smaller investment and build up to larger dividends.

While some investors may choose to perform their own due diligence, it is helpful to remember that Brokerage firms have analysts who perform this specific due diligence on a daily basis and have years of practice reviewing REITs for investment. It is wise to work with a qualified financial planner versus researching and investing solo.

REIT investing is a cornerstone of a diversified portfolio. So, how much of a portfolio should be specifically allocated to REIT investing?

To answer this question, let’s first take a look at the Yale Endowment Method. Yale’s endowment is notorious for being well-diversified and equity-oriented. A lot can be learned from how the Yale endowment allocates its investments.

With a 9.5% investment in real estate within an investment portfolio, the goal of the Yale Endowment Method is to lower risk and raise return, while protecting investors against inflation. Because REITs are an illiquid investment, investors are locked in, removing the temptation of reactive selling during market down periods.

David Swensen, creator of the Yale Endowment Method, crafted a specific portfolio for individual investors based on his model. Referred to as the Swensen Portfolio, the asset allocation includes 20% to REITs. For individuals looking to invest using this model, always consult your financial advisor first.

Silver Star Properties REIT operate multiple REIT funds throughout Texas. We provide our tenants exceptional service based on inspired values, which enriches their experience and builds a strong value chain.

To learn more about our company, visit our About Us page.

Resources

REIT Education

News & Multimedia

Contact

Shareholder Forms:

Silver Star Properties REIT, Inc.

P.O. Box 2189

San Rafael, CA 94912

844-932-1769

Corporate:

Silver Star Properties REIT, Inc.

2909 Hillcroft, Suite 420

Houston, Texas 77057

713-467-2222

800-880-2212

1 Silver Star Properties REIT, Inc. and its affiliates. Results are not guaranteed. Past performance is not indicative of future results. Please refer to the Prospectus for more information and important disclosures.

THE CONTENTS OF THIS WEBSITE CONSTITUTE NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY ANY SECURITY; OFFERS CAN BE MADE ONLY BY THE PROSPECTUS OR PRIVATE PLACEMENT MEMORANDUM. THIS MATERIAL MUST BE READ IN CONJUNCTION WITH THE PROSPECTUS IN ORDER TO FULLY UNDERSTAND ALL OF THE IMPLICATIONS AND RISKS OF THE OFFERING OF SECURITIES TO WHICH IT RELATES. A COPY OF THE PROSPECTUS MUST BE MADE AVAILABLE TO YOU IN CONJUNCTION WITH ANY OFFERING.

NO OFFERING IS MADE EXCEPT BY A PROSPECTUS FILED WITH THE DEPARTMENT OF LAW OF THE STATE OF NEW YORK. NEITHER THE ATTORNEY GENERAL OF THE STATE OF NEW YORK NOR ANY OTHER STATE REGULATORS HAVE PASSED ON OR ENDORSED THE MERITS OF THIS OFFERING. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

Performance Not Guaranteed: Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are not guaranteed and may not reflect actual future performance.

Risk of Loss: All securities involve a high degree of risk and may result in partial or total loss of your investment.

This is a website owned and operated by Silver Star Properties REIT, Inc. By accessing this site and any pages thereof, you agree to be bound by our Terms and Conditions and Privacy Policy. Neither Silver Star Properties REIT, Inc. nor its affiliates provide investment advice or make investment recommendations. No communication, through this website or in any other medium, should be construed as a recommendation for any security offering on or off this investment platform.

Copyright © 2021 All Rights Reserved | Privacy Policy | Terms of Use